The Battle Against Red Tape: One Family's Struggle

Let me tell you a story about Debra, a New Yorker who found herself stuck in a bureaucratic nightmare. Her mom, Myrna Hoffman, who suffers from dementia, was issued her 2023 tax refund. But here's the kicker: Debra couldn't cash it because the IRS made a typo in her mom's name. Imagine this—Debra's mom needed that $11,000 desperately for medical expenses, but it was stuck in a system that felt more like a maze than a solution. This wasn't just a typo; it was a life-altering mistake that left Debra fighting tooth and nail to get her mom's refund.

Why IRS Mistakes Happen and How They Block Your Refunds

So, why do these kinds of mistakes happen? Well, the IRS processes millions of tax returns every year, and with that volume, errors can slip through the cracks. In Debra's case, it was a simple typo in her mom's name that caused the entire refund to be held up. Now, here's the kicker: when a refund is blocked, it can feel like you're stuck in limbo. You're waiting for the IRS to fix something that shouldn't have happened in the first place. But let's dive deeper into why these errors occur and what you can do about it.

IRS errors can happen for a variety of reasons—data entry mistakes, outdated systems, or even human error. The bottom line is that these mistakes can block your refund, leaving you scrambling to figure out what went wrong. That's why it's crucial to know your rights and the steps you can take to ensure your refund is processed correctly and efficiently. In this article, we'll break down everything you need to know to protect yourself from IRS errors.

Read also:Lowya652881252312458125166528912364124181238312425123771245212531124861252212450387612162965306sns123913544138988278323947212398260322486335226124711251912540125231254012512

What Happened Next: Persistence and Media Pressure

Debra's story is a testament to the power of persistence and media pressure. After months of trying to get through to the IRS, she finally reached out to local news outlets. The attention from the media put the IRS on notice, and soon after, the issue was resolved. Her mom's refund was finally released, and the family could breathe a sigh of relief. But here's the thing: not everyone has the resources or the platform to get their story out there. That's why it's so important to arm yourself with knowledge and be prepared to fight for what's rightfully yours.

The Bigger Picture: IRS Refunds in 2025

As of January 31, the average refund amount totaled $1,928, according to the IRS. That's a significant increase compared to the $1,395 for the same period in 2024. But here's something even more interesting: the average direct deposit refund for 2025 was even higher, at $2,069. So, what does this mean for taxpayers? It means that the IRS is issuing larger refunds this year, which is great news for those who are counting on that extra cash to make ends meet.

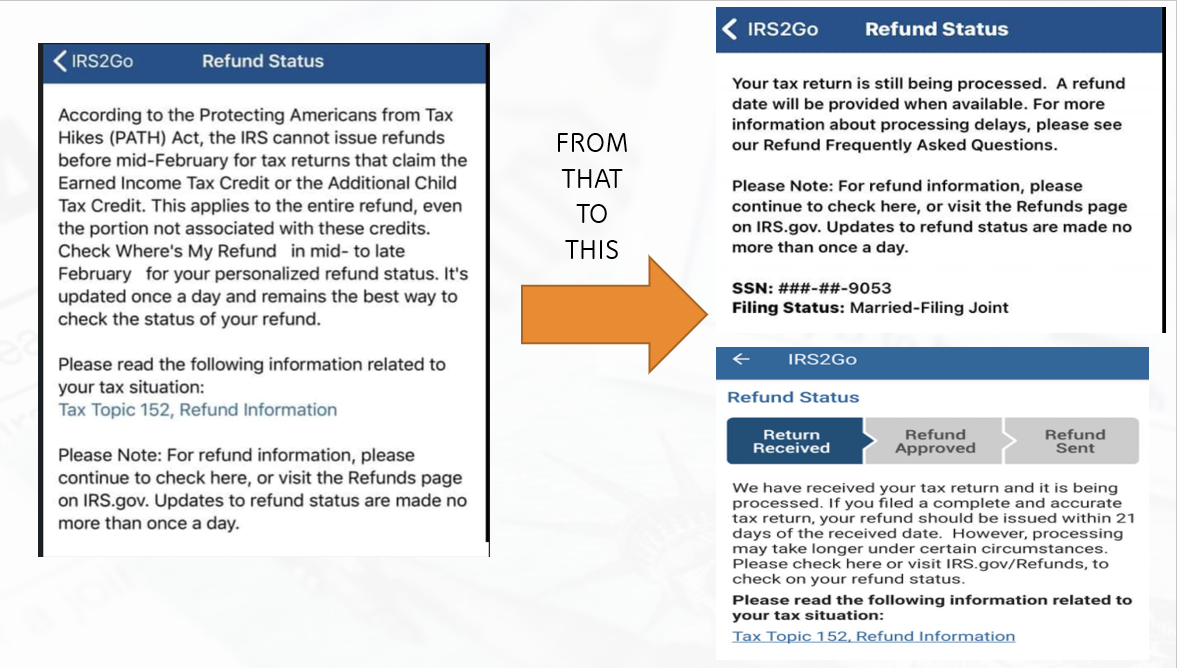

But wait, there's more. The IRS has an online tool called "Where's My Refund?" that allows you to check the status of your refund. It's a simple and effective way to stay informed about your refund's progress. Just enter your Social Security number, filing status, and the exact amount of your refund, and you'll get an update on where things stand. It's like having a personal assistant keeping tabs on your money for you.

Understanding Your Tax Refund: Key Insights

Let's break it down further. If you're dealing with a $11,000 tax refund block—or any other amount—it's essential to understand your rights and the steps you can take. First, know that you're not alone. Thousands of taxpayers face similar issues every year, and the IRS has processes in place to resolve them. But sometimes, you have to be your own advocate and push for resolution.

For example, if you're dealing with an offset—where the IRS uses your refund to pay off an unpaid balance—you'll receive a notice explaining the situation. You can also set up new payment plans through the IRS website. It's all about staying informed and taking action when necessary. And let's not forget the power of knowledge. The more you know about the IRS and how it operates, the better equipped you'll be to handle any issues that come your way.

What About the Doge Stimulus Check 2025?

Now, let's talk about the proposed Doge Stimulus Check 2025. This idea has been making headlines across the U.S., sparking debates and discussions about economic relief. While it's still just a proposal, it highlights the ongoing conversation about how best to support Americans during challenging times. Whether it happens or not, it's a reminder that staying informed about tax-related news is crucial for your financial well-being.

Read also:Mary Mouser Erome Unveiling The Star Beyond The Spotlight

Final Thoughts: Knowledge is Power

Debra's story is a powerful reminder of the importance of persistence and knowledge when dealing with the IRS. Whether you're fighting for a $11,000 tax refund or simply trying to stay informed about your taxes, knowing your rights and the steps to take can make all the difference. Remember, the IRS is a massive organization, and mistakes can happen. But with the right approach, you can navigate the system and get the outcome you deserve.

So, the next time you're faced with an IRS issue, take a deep breath, gather your information, and don't be afraid to speak up. You've got this. And if you ever find yourself in a situation like Debra's, remember that persistence and media pressure can sometimes be the key to resolving even the most frustrating bureaucratic hurdles. Stay informed, stay strong, and let your voice be heard.