Hey there, it’s me—your friendly guide to navigating the tricky waters of modern life. Today, we’re diving into something that affects us all: identity theft. In a world where everything from our bank accounts to our social media profiles lives online, it’s more important than ever to stay vigilant. Let’s break down what identity theft is, how it happens, and—most importantly—how you can protect yourself and your family. Trust me, this is crucial stuff we all need to know.

Why Identity Theft Matters

In today's digital age, identity theft isn't just a distant worry—it's a real and growing threat. Every day, cybercriminals are finding new ways to exploit the vast amount of personal information floating around online. From hacked databases to phishing scams, the risks are everywhere. But don’t panic! Understanding how these criminals operate is the first step toward protecting yourself. Let’s take a closer look at what identity theft is and why it’s such a big deal.

Understanding the Risks

Imagine waking up one day to find someone has drained your bank account, opened credit cards in your name, or even used your identity during a criminal arrest. Sounds like a nightmare, right? Unfortunately, this is the harsh reality for millions of people each year. Identity theft doesn’t just cause financial devastation—it can ruin your credit score, take years to repair, and leave you feeling violated and powerless. But here’s the good news: with the right precautions, you can significantly reduce your risk of becoming a victim.

Read also:Actress Masterson Unveiling The Rising Star Of Hollywood

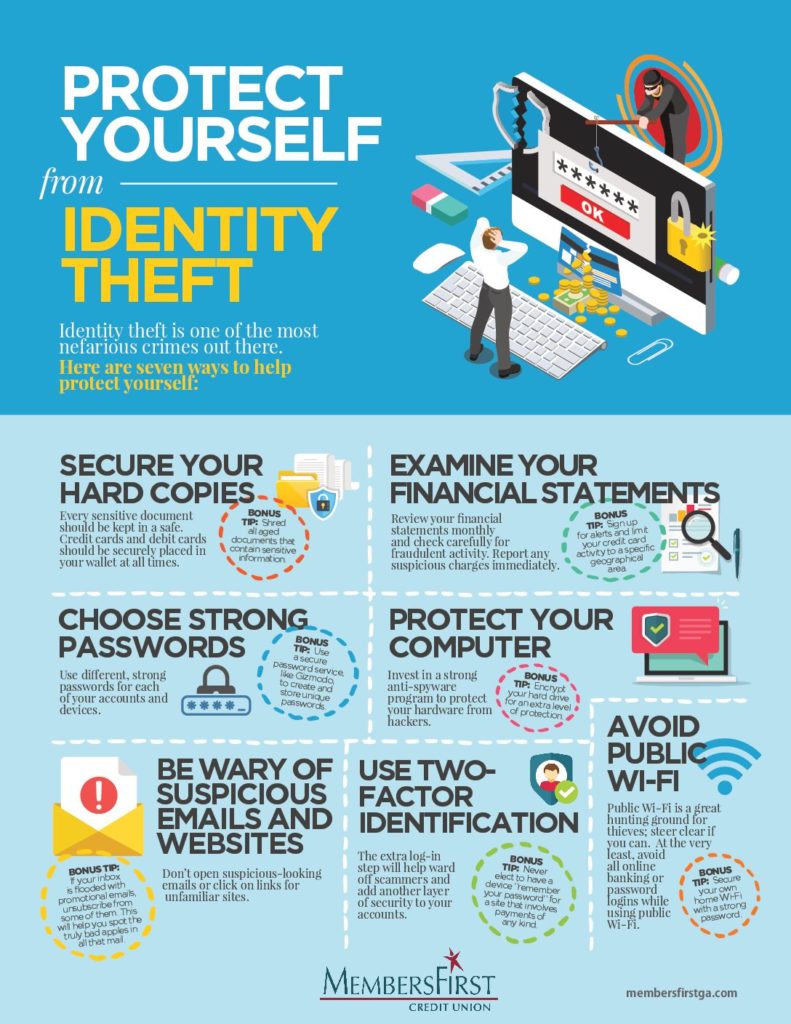

Top Tips to Prevent Identity Theft

Let’s face it: no one wants to deal with the headache of identity theft. The good news is, there are simple yet powerful steps you can take to keep your personal information safe. From freezing your credit to monitoring your accounts closely, here’s how you can stay ahead of the scammers.

1. Freeze Your Credit

One of the most effective ways to prevent identity theft is by freezing your credit. This simple step prevents anyone from opening new accounts in your name without your permission. And guess what? It’s free and takes just a few minutes to set up. Why wouldn’t you do it? Trust me, it’s worth the effort.

2. Monitor Your Accounts Regularly

Staying on top of your bank and credit card statements is key. Regularly reviewing your transactions can help you spot any suspicious activity early. Early detection is your best defense against identity theft. If you notice anything unusual, report it immediately to your bank or credit card company. They’re on your side and can help you investigate further.

3. Secure Your Personal Information

Whether it’s your Social Security number, birth certificate, or other sensitive documents, make sure they’re stored securely. Don’t leave them lying around where someone could easily access them. And when it comes to digital information, use strong, unique passwords for all your accounts and enable two-factor authentication whenever possible.

What to Do If You’re a Victim

Unfortunately, even the most cautious among us can fall victim to identity theft. If you suspect someone has stolen your identity, don’t panic. Here’s what you need to do right away:

Report It Immediately

Time is of the essence. The sooner you act, the better your chances of minimizing the damage. Start by contacting the Federal Trade Commission (FTC) at IdentityTheft.gov. They’ll guide you through the process and help you create an identity theft report and recovery plan. You’ll also want to file a report with your local police department and keep a copy for your records.

Read also:Amanda Animal Hospital Inc Your Trusted Companion For Pet Care

Notify Financial Institutions

Reach out to your bank, credit card companies, and any other businesses where fraud may have occurred. Let them know what’s happened and ask them to flag your accounts for suspicious activity. They can help you freeze your accounts or issue new cards to prevent further damage.

Place a Credit Freeze or Fraud Alert

As I mentioned earlier, freezing your credit is one of the best ways to stop identity thieves in their tracks. If you haven’t already done so, contact one of the three major credit bureaus—Equifax, Experian, or TransUnion—to place a freeze on your credit. Alternatively, you can request a fraud alert, which notifies lenders to verify your identity before opening new accounts.

Staying Safe in a Digital World

With technology evolving at breakneck speed, staying safe online requires constant vigilance. Here are a few more tips to help you protect your digital footprint:

Be Mindful of Your Online Accounts

From social media to online shopping, we all have countless accounts that require personal information. Make sure you’re using strong, unique passwords for each one and enable two-factor authentication wherever possible. Also, be cautious about sharing too much personal information online—scammers can use it to piece together your identity.

Keep an Eye on Your Mail

Believe it or not, mail theft is still a common way identity thieves gain access to your information. Always shred sensitive documents before throwing them away and consider using a locking mailbox or PO box to keep your mail safe.

Final Thoughts

Identity theft is a scary reality in today’s world, but it’s not something you have to face alone. By taking proactive steps to protect your personal information and staying vigilant, you can significantly reduce your risk of becoming a victim. Remember, knowledge is power. The more you know about how identity theft works and how to prevent it, the better equipped you’ll be to protect yourself and your loved ones.

So, take a deep breath, roll up your sleeves, and let’s get started. Together, we can make identity theft a thing of the past. Stay safe out there!